Question by Troy Friesen on Apr 17, 2014

Q. What is your advice for Canadian companies who are looking into becoming a multinational?

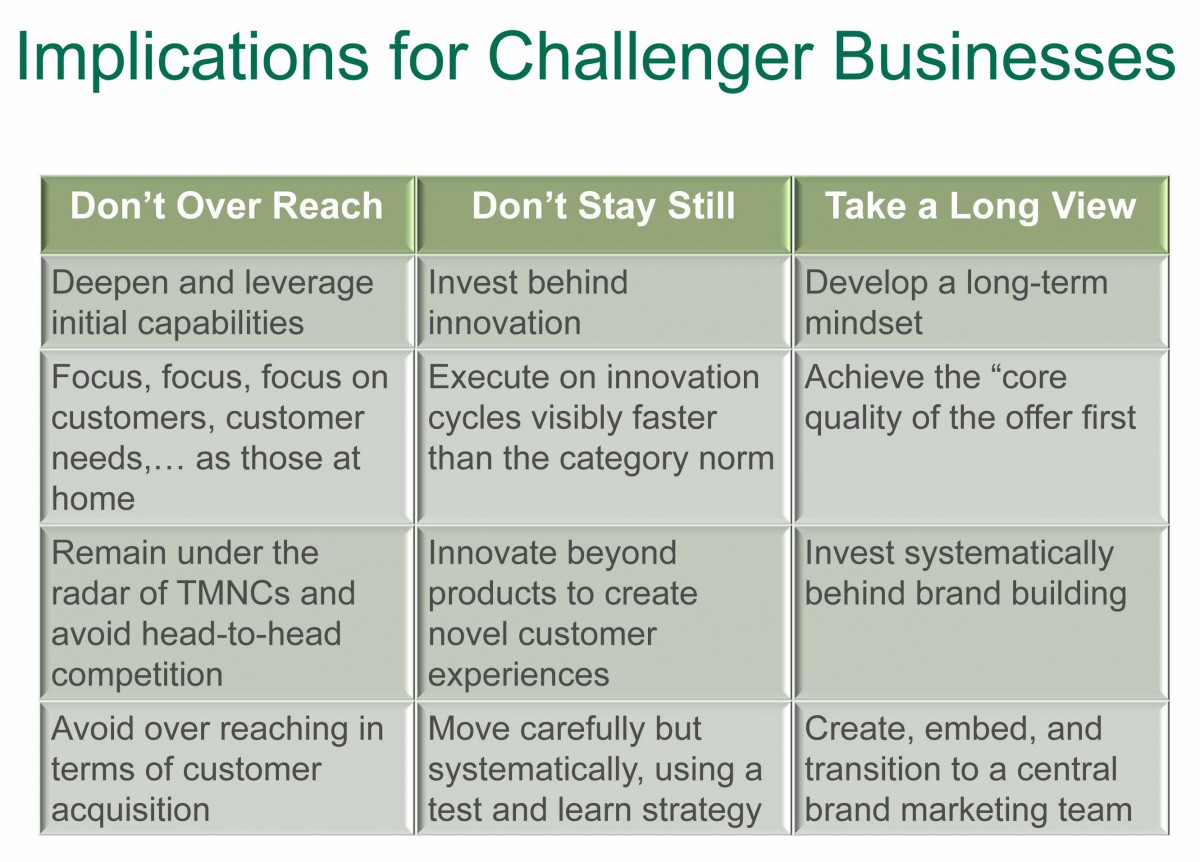

The lessons for Canadian companies looking to become multinationals is the same as that we offer to EMNCs in our book The New Emerging Market Multinationals: Four Strategies for Disrupting Markets and Building Brands: Don’t over reach, don’t stay still, and take a long view. Let me elaborate on each of the three. By don’t over reach, we mean that the firm needs to remain focused on its core business, be that customer segments, technologies, product categories, and the like. While doing so, they need to deepen their capabilities by investing in them and then leveraging the same to expand in to new markets abroad, to the degree possible, initially choosing markets that are not occupied or heavily contested by the MNCs.

A good example is Mexico’s Grupo Modelo. From the large portfolio of beers it markets at home, it focuses on one beer internationally, Corona Extra. It sells it on a platform of relaxation the world over and competes as a “import” in the markets that it operates in. Initially, it targeted holidayers in Mexico who wanted to remember the good times by drinking a bottle of Corona Extra. Corona Extra has been so successful that it is now the largest selling imported beer in the US, having overtaken Heineken!

Don’t stay still is our second recommendation. It is about investing behind innovation, doing so cleverly to achieve superior results with faster cycle times, but do so judiciously, using a test and learn strategy, so as not to break the bank if some initiatives fail. A good example of this is Brazil’s Natura. Natura is a pioneer in open innovation, long before the term became a management buzzword. They have a small in-house R&D team and collaborate with universities and research institutes in Latin America, Europe, and elsewhere, supporting appropriate projects, which they monitor closely and bring in-house only when the look commercially promising.

Natura has combined its sales, marketing, and R&D under a single business development head. This allows the R&D to be customer focused, and because of its direct sales model it is able to put innovations in to the market and use sales uptake and customer feedback gathered through its direct sales force to make decisions on how to take the business forward. Natura’s innovation machine is lean and effective. They spend 2.5% of their revenues on R&D compared to over 3% at L’Oreal, the world’s leading purveyor of cosmetics. Importantly, the 2.5% spend is on a much smaller revenue base, an order of magnitude smaller than L’Oreal. Yet, Natura is able to bring to market successful innovations to market as well as the best in breed. Over the past 10 years, approximately 65% of revenues have come from products launched in the previous two years and Natura has expanded throughout Latin America and now is present in Western Europe, which it entered through France. You can read more about this in my published case study.

The third recommendation is take a long view. Going global is a big leap forward and it takes time; thus you need a long term mindset. We recommend taking a long view and focusing on the quality of the core offer and ensuring that it is world class, investing systematically behind brand building, and developing the management capabilities that allow you to manage the brand internationally from a central location.

India’s Marico offers a good example. Over the past decades it has not only developed quality product offerings, but developed them to occupy specific customer need niches in particular markets. It has systematically invested in brand building, investing behind some of its core brands like Parachute Advansed, originally a hair oil brand that now offers a range of post-wash hair care products. It has developed world leading capabilities in dealing with fragmented distribution channels, enabling to garner strong support for its brands from the mom and pop stores that are ubiquitous in the markets it primarily serves–South Asia, Middle-East, and North Africa. It has created a central marketing team at its headquarters in Mumbai, India and is slowly but systematically centralizing marketing strategy and support functions there, leaving the local activation of strategy in the hands of local markets, just as the leading MNCs do. This latter step is still evolving and it will take time. Marico understands it is a journey and is taking it one step at a time.